Stocks. Bonds. Mutual Funds. Health Savings Accounts. 401(k)’s, Traditional, and Roth IRA’s. With so many different types of investment vehicles, it can be difficult to determine what retirement tools are the right combination for your situation.

Stocks. Bonds. Mutual Funds. Health Savings Accounts. 401(k)’s, Traditional, and Roth IRA’s. With so many different types of investment vehicles, it can be difficult to determine what retirement tools are the right combination for your situation.

Obviously a well diversified portfolio of stocks & mutual funds, bonds, precious metals, along with life insurance and liquid assets, is probably a good hedge as well as a long term investment solution. But what is the right mixture of these different investment vehicles. Do you need a more aggressive approach to investing because you didn’t start until later in life? Or can you put your capital behind a more conservative, long term approach because you are still young and have more time before you retire?

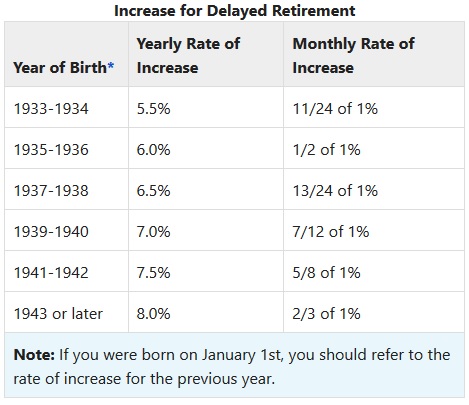

Relying on Social Security alone isn’t usually enough to carry someone through retirement. In the past, certain married couples were able to use a rule to “file and suspend” one spouse’s Social Security benefit, allowing that benefit to accrue Cost of Living Adjustments and get those adjustments applied to the total back pay owed to them from the time they filed. Now, that rule has been eliminated by Congress, because in the eyes of lawmakers, Social Security beneficiaries shouldn’t “receive one benefit while also receiving a bonus on another benefit”. Retirees can still claim Delayed Retirement Credits by just waiting to file for Social Security until a later date.

Along with accumulating enough wealth, reaching retirement age, and filing for Social Security, health insurance is also a concern. Signing up for Medicare is another requirement for this age group. With so many things happening at once, and with such preparation required, it is vital to work with the right financial planner.

Our licensed associates can help your business set up retirement plans that can help you and your employees make smart, safe investments while educating them on the types of investments they need above and beyond their 401(k), Simple IRA, or deferred compensation plan as the case may be. Tax savings, early withdrawal penalties, contribution limits, non-diversified or unbalanced portfolios, Medicare enrollment, among other things, are very real concerns for the working man or woman reaching retirement age. Don’t do this alone.

At Integrated Benefit Solutions, we are here to provide a holistic approach to retirement and investing. Contact us today to find out how we can help your organization in this area.

Please contact us today to see how we can help plan your retirement