IRS to block, suspend tax returns that lack Obamacare disclosures

- The IRS says it will not accept electronic tax returns that do not disclose whether the filer had health insurance coverage during the year.

- It also says it will suspend paper returns that do not have the disclosure.

- The IRS’ move, which will bolster compliance with Affordable Care Act rules, comes as the Trump administration takes other steps to undercut the law.

The new move to tighten Americans’ compliance with the Affordable Care Act comes even as the Trump administration takes steps to undercut it.

“Taxpayers remain obligated to follow the law and pay what they may owe at the point of filing,” the IRS said in a description of the new policy.

That penalty is the higher of 2.5 percent of adjusted gross household income or $695 per adult and $347.50 per child under age 18.

The agency, in an online notification to tax professionals, said that in the upcoming tax filing season “the IRS will not accept electronically filed tax returns where the taxpayer does not address the health coverage requirements of the Affordable Care Act.”

“Returns filed on paper that do not address the health coverage requirements may be suspended pending the receipt of additional information and any refunds may be delayed,” the IRS said.

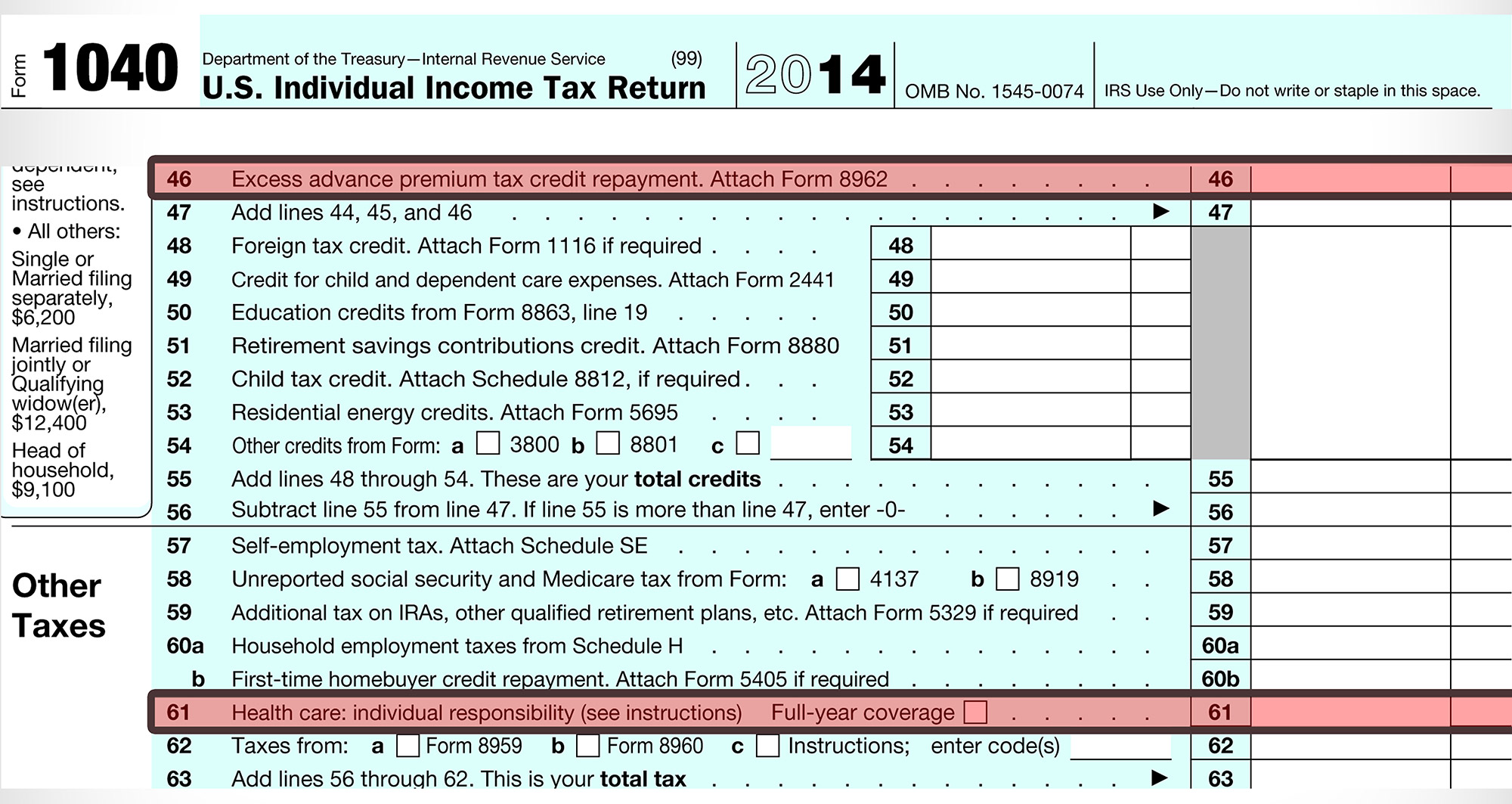

Income tax returns contain a box that asks filers if they had health coverage during the year.

If they indicate they did not have coverage, filers must indicate on what grounds they are exempt from the mandate or say they will pay and then calculate the penalty for not complying.

The IRS said it will not accept electronically filed returns until a tax return addresses those points.

There are several possible exemptions from the mandate, including lacking access to affordable health coverage, being homeless, getting evicted, experiencing domestic violence, experiencing the death of a family member and filing for bankruptcy.

We will be updating our website as more information comes out about any changes in the health law.

In other news:

Some Tax Benefits Increase Slightly, Others Unchanged

The Internal Revenue Service (IRS) has announced a number of inflation-adjusted tax items for 2018, some of which remain unchanged. Among other items, the annual dollar limit on employee contributions to employer-sponsored health flexible spending arrangements (FSAs) increases to $2,650 (up from $2,600).

Other Items of Interest

Other inflation-adjusted items for tax year 2018 that may be of interest to employers and employees include the following:

- Qualified Transportation Fringe Benefits. For tax year 2018, the monthly limitation for the qualified transportation fringe benefit rises to $260 (up from $255 for 2017) for transportation and qualified parking.

- Qualified Small Employer Health Reimbursement Arrangements (QSEHRAs). For tax year 2018, to qualify as a QSEHRA, the total amount of payments and reimbursements cannot exceed $5,050 per employee (up from $4,950 for 2017) or $10,250per family (up from $10,000 for 2017).

- Archer MSAs. The 2018 limits for annual deductibles and maximum out-of-pocket expenses for high deductible health plans (HDHPs) are as follows:

- Self-only coverage. The plan must have an annual deductible that is at least $2,300 (up from $2,250 for 2017); but not more than $3,450 (up from $3,350 for 2017). The annual out-of-pocket expenses required to be paid (other than for premiums) for covered benefits cannot exceed $4,600 (up from $4,500 for 2017).

- Family coverage. For tax year 2018, the floor for the annual deductible increases to $4,600 (up from $4,500 for 2017), however the deductible cannot be more than $6,850 (up from $6,750 for 2017). The annual out-of-pocket expenses required to be paid (other than for premiums) for covered benefits cannot exceed $8,400 (up from $8,250 for 2017).

- Earned Income Credit. The maximum Earned Income Credit amount is $6,444 for taxpayers filing jointly who have 3 or more qualifying children (up from a total of $6,318 for 2017). IRS Revenue Procedure 2017-58 includes a table that provides maximum credit amounts for other categories, income thresholds, and phase-outs.

For More Information

Details on these inflation adjustments and others are contained in Revenue Procedure 2017-58.

Please check out this article about debt stress and how it impacts you: https://www.carefulcents.com/debt-stress/