“Experience is the thing of supreme value” ~ Henry Ford

When working with a broker, typically the employer doesn’t pay the broker directly for their services. Brokers are paid commission, usually a percentage of the premiums paid for the various lines of coverages that the employer group maintains.

So that begs the question: How do you measure the value of your broker?

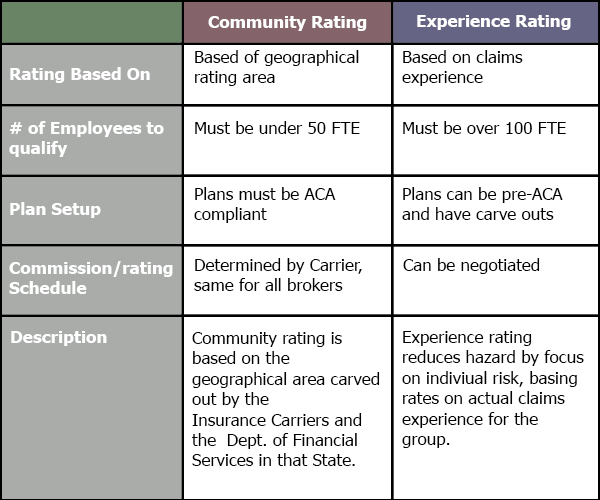

Because NY is “community rated”, which means that in the 8 counties of Western NY (and any other community rated area), the price for an Independent Health Gold plan in Chautauqua county is the same price as an Independent Health Gold plan in Erie county. For “experience rated” groups over 100 full time equivalent employees, the group rating is based on claims experience and can only differ between the insurance carriers (the broker has little control over this other than threaten to take their business elsewhere, which may result in 1/2% of a rating decrease…possible, but unlikely).

So how can a broker possibly eek out extra money from their clients rather than take the set percentage of the premium from the plans the client chooses? The right answer is they don’t.

Some brokers will only show clients higher cost plans in order to garner a higher percentage of commissions. Some brokerage agencies rent high-end software exchanges in order to be man-in-the-middle between their groups and the insurance carriers, taking custody of customer funds and getting a higher percentage of the premium by charging more up front for plans that don’t actually cost that much and pocketing the difference.

We believe these practices are underhanded and dishonest, and do the client a major disservice. At Integrated Benefit Solutions, our software is free. We don’t try to push clients into higher cost plans just so we get a better cut of the proceeds. In some cases we’ve taken a lower percentage, or no commission entirely, for a group who has fallen on hard times in their respective industry. We’ve been offered money from individuals for consulting them on other insurance matters, and we simply won’t take it.

Our philosophy is simple: the money is secondary. Our primary objective is to help employer groups save time and money by presenting them the best plans for their circumstances; not bogging the employer down with poor plan choice, technological smoke and mirrors, per employee per month costs, poor customer service, etc…our best asset as your broker is the desire to do what’s best for you even if it’s not the best outcome for us. When our clients reach out to us for help on any issue, we devote ourselves to helping them and finding out what is the next right thing to do. We have faith that if we do the right thing for our clients, we will be successful. This is our experience.

This principle has guided us for over 30 years, and we hope it will continue to guide us as we continue our journey in the world of employee benefits.